Pay off the liability and stay wary

A concept that came up during studying asset liability management was when to pay down liabilities and when to increase exposure under return seeking behavior. This involves ideas of optimal stopping and duration gaps. Examples that come to mind are Silicon Valley Bank and the squeeze suffered by UK pensions when Gilts volatility increased. A common theme found through the research I do is through extremal events. Let us look at the problem formally.

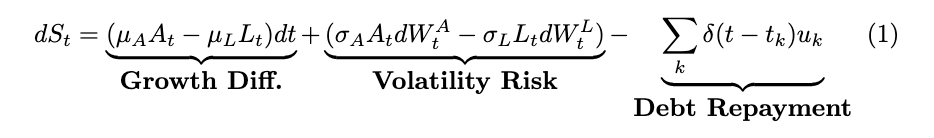

The dynamics of our portfolio is a combination of growth of assets and liabilities, the vol, and repaying debt.

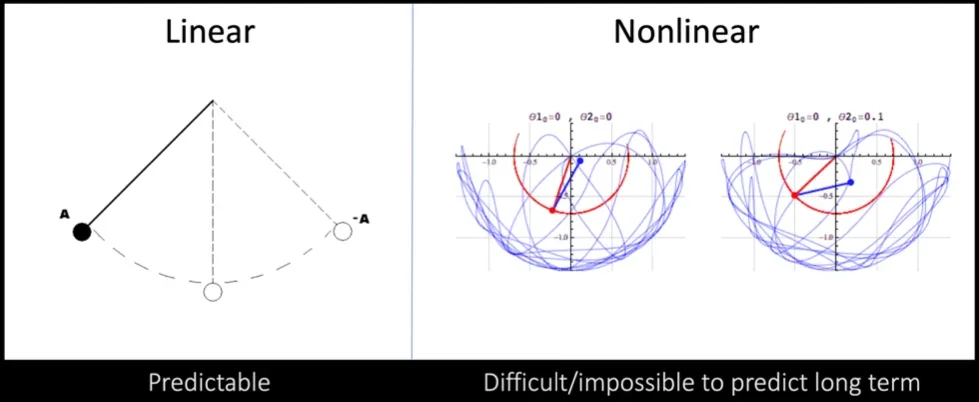

The trouble is caused when the volatility of the liabilities are estimated naively with linear assumptions and that the growth of the asset, lets say treasuries, will outperform the liability. Other than the fact that trying to model the dynamics is a whole world of its own, the traditional way to look at this is prone to even a slight shock. Whats not seen in the model is a cross correlation with some assets and liabilities. If a firm engages in a carry trade or in Repo markets or relies on parity for returns, you can only withstand so much before the model breaks.

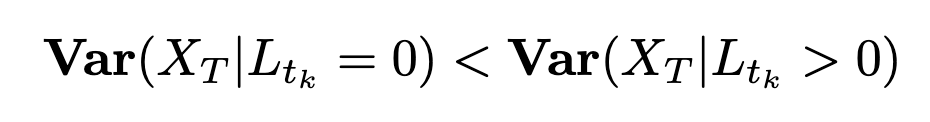

What we need to consider is path dependency and vol of vol. If we take paths that show lower amounts of total liabilities, naturally our exposure to risk. What most do not seem to understand is that there are still paths with low liabilities that will cause ruin. If this case is true for excess surplus, think about how it may be for deficit scenarios.

This somewhat reminds me of a double pendulum and its non linear behavior. One part of it swings just a little bit more than its supposed to, it goes crazy.

So any time you have an opportunity to pay off a liability, do it so you don’t think of possibilities of getting squeezed.